Federal Tax Authority

-

Prime Contractor: Leading IT Solutions Provider

- Subcontractor: Consulting & Technical Services Provider

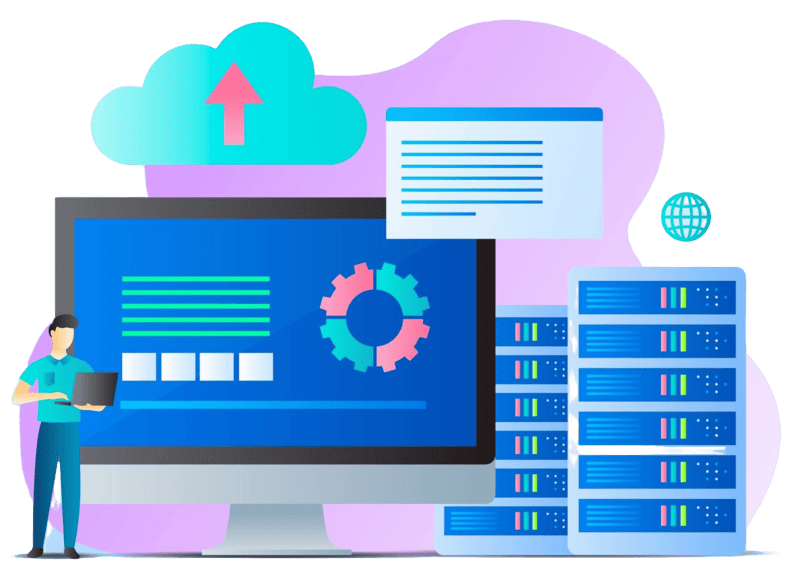

Modernize legacy systems for processing business tax documents to meet evolving regulatory demands and enhance system scalability.

Requirements & Analysis

Defined system requirements and guided architectural updates.

System Design

Replaced outdated technology with modular, scalable solutions.

Data Integration

Migrated to real-time data processing.

Security Compliance

Ensured adherence to NIST 800-53 standards.

Performance Optimization

Improved processing speed and data accuracy.

Service-Oriented Architecture (SOA)

Scalable, modular services

Cloud & Middleware

Enabled real-time integration and secure data exchange.

Security

NIST 800-53 compliance tools.

| Aspect | Before | After |

|---|---|---|

| Batch Processing | Legacy batch processing | 95% transitioned to real-time |

| Data Access | Delays in access times | 40% faster data retrieval |

| System Availability | Less reliable | 99.99% availability |

Reduced legacy batch processing by

0

%

transitioning to real-time solutions.

Improved data access times by

0

%

Accelerated tax return processing by

0

%

Enhanced user experience through optimized system design.

- Achieved seamless modernization of legacy systems to a service-oriented platform.

- Achieved seamless modernization of legacy systems to a service-oriented platform.

- Maintained operational continuity and reliability.

- Increased overall system transparency and accountability.